New blog posts

Warum GoodWe in Leipzig die Vorreiterrolle für erneuerbare Energien einnimmt

14 September, 2024 by Evionyx Solar

Die Zukunft der Energiegewinnung ist grün,...

Find Old Tractors at Affordable Rates to Enhance Your Farm’s Productivity

13 September, 2024 by tractor factory

Are you a farmer looking to boost your...

Find Old Tractors at Affordable Rates to Enhance Your Farm’s Productivity

13 September, 2024 by tractor factory

Are you a farmer looking to boost your...

Web Directory

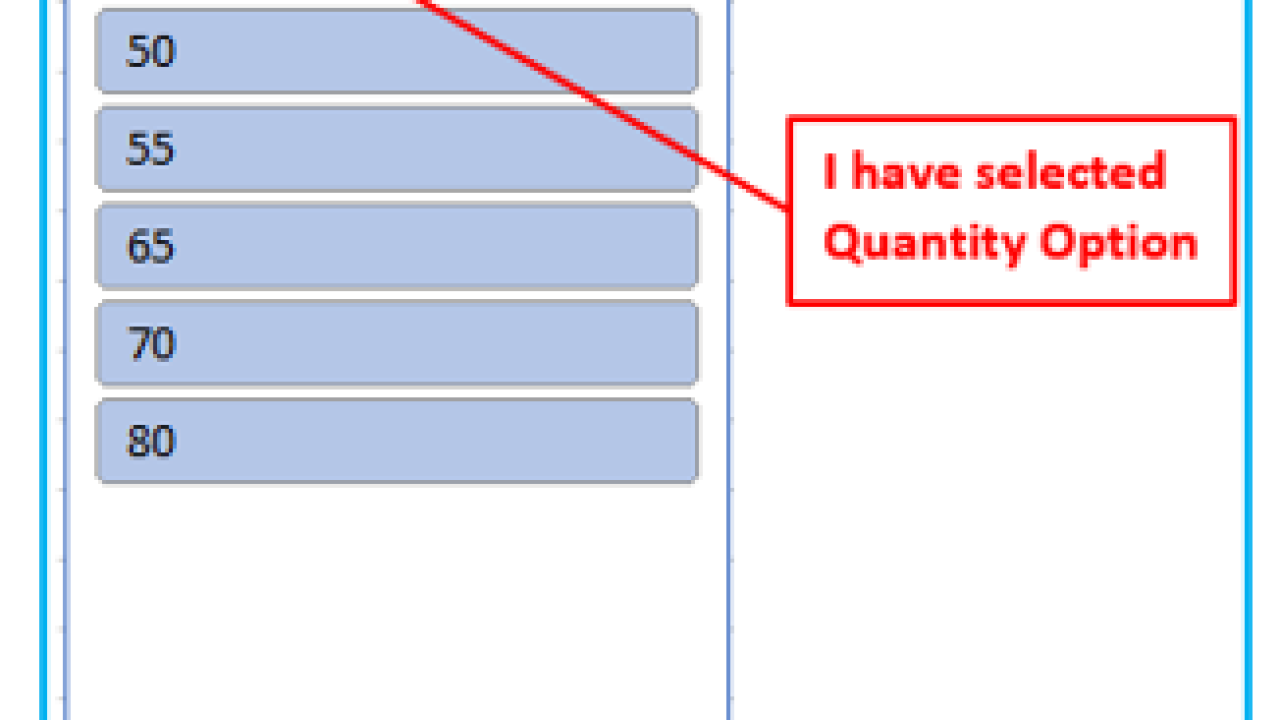

What is a Pivot Chart in Excel

Posted on 30 January, 2023 by pivotchartss

I suppose the most vital fact, yes I stated reality, concerning pivots points is they may be a prediction of destiny help and resistance degrees. The key phrase inside the previous sentence is "prediction" and traders ought to preserve that during thoughts when trading pivot factor structures. I actually have always been conflicted as to why pivot factors (PP) end up vital at some point of the course of the day. Most traders start their day by way of plotting pivot factors onto their chart. With such a lot of people the use of comparable formulas to plot PP it is little marvel that the marketplace stops on the calculated support and resistance stages. Do the help stages and resistance tiers occur due to the fact every person is the usage of a similar machine or are they a part of the herbal characteristic of the marketplace?

what is a pivot chart in excel

As a dealer I am most effective interested in what the market does, no longer why it reveals positive tendencies. I comprehend that could be a bit of an obtuse solution, however it's far one I actually have learned to live with effectively. Of course, it's miles often mentioned among investors and every day trader has his opinion, however to exchange the markets it is not necessarily essential why this phenomena takes place.

On the opposite hand, some days the marketplace can pay sincerely no interest to pivot factors and goes along its merry manner with out preventing at any unique factor on the chart. More regularly than now not, even though, the marketplace will stop at the pivot points, or pause, or reverse right on the plotted lines. My point is a easy one; pivots are very useful, besides when they're no longer beneficial. Whether the marketplace will adhere to the predicted support and resistance is some thing which you should glean from watching the price motion for a chunk. I generally don't provoke my first alternate of the day based on pivot points.

Break outs frequently time occur when the market is in a consolidating mode and forms a horizontal channel, with the price banging off the top and backside of the channel, mainly if the channel is on a assist/resistance line, as is often the case.. After this price movement keeps for two, maybe 3 cycles, I will set a promote a point under the channel and a buy a factor above the channel. (I am referring to the ES contract right here) Generally the fee motion will escape of the channel and hold in the course of the get away and also you pick out up the trade as it blasts via the channel parameters. This is a pretty right approach and can be very worthwhile.

Breakdowns also are a excellent way to use your pivots. This exchange is mainly proper if the market has been hitting a aid/resistance line and stopping. As the fee action procedures the guide/resistance line, I will set a buy one point below the line in hopes of choosing up the alternate as it pierces the line. This exchange may be a piece dodgy, particularly if the market has been bouncing off the lines all day because the earlier bounces had been generally observed a move inside the different course. Your wish is that the flow does no longer undergo the line a bit (as it frequently does), choose up your change and alternate directions. Again, here you can set your order decrease, perhaps 1.5 points below the road in case you are uncomfortable.

Finally, you alternate the pullbacks from R and S. Let's say the marketplace pierces S1 and heads straight to S2 and prevents and reverses. Often instances the alternate in course will move immediately to S1 once more, retracing it is pass down within the opposite route. Once it reaches S1 I will set a change 1 factor below S1. More regularly than not, the trade will hit S1 and reverse field to the quick side, and if it maintains upward you stayed out of the exchange by virtue of placing your promote 1 factor below S1. This likely my favored pivot point alternate, and springs with a better degree of safety than maximum. Of course, no particular alternate works each time. If I am stopped out two times on a pivot point change, I forget about pivot factors for the relaxation of the day.

In precis, we learned that pivot points are predictors of future interest. Further, as predictors they may or may not be powerful on a given day of buying and selling. Your energy of statement is fundamental to know-how the effectiveness of a pivot factor each trading day. We reviewed three basic trades that I use; the breakout, breakdown and pullback. If you discover ways to combine your trades with an oscillator or a tick chart, you'll broaden or even highe

https://latestsms.in/funny-good-morning-sms.htm

24 July, 2024

https://www.cargoes.com/rostering-system

23 November, 2022

https://www.cargoes.com/rostering-system

92517 Views

http://aptrondelhi.in/

26513 Views

https://www.oceanholidayz.com/

23 December, 2019