New blog posts

Warum GoodWe in Leipzig die Vorreiterrolle für erneuerbare Energien einnimmt

14 September, 2024 by Evionyx Solar

Die Zukunft der Energiegewinnung ist grün,...

Find Old Tractors at Affordable Rates to Enhance Your Farm’s Productivity

13 September, 2024 by tractor factory

Are you a farmer looking to boost your...

Find Old Tractors at Affordable Rates to Enhance Your Farm’s Productivity

13 September, 2024 by tractor factory

Are you a farmer looking to boost your...

Web Directory

Streamlining Financial Accuracy with Automated Account Reconciliation

Posted on 3 August, 2024 by Kosh.ai

In the complex realm of financial management, maintaining accurate and synchronized financial records is essential for organizational success. Traditional account reconciliation, which involves manually verifying and matching transactions between internal records and external statements, can be cumbersome and error-prone. Automated account reconciliation offers a modern solution to these challenges, enhancing accuracy, efficiency, and overall financial control. Here’s how automated account reconciliation is revolutionizing financial operations.

What is Automated Account Reconciliation?

Automated account reconciliation refers to the use of software to automate the process of matching transactions from internal financial records with external statements, such as bank statements, supplier invoices, or credit card statements. The software leverages advanced algorithms and technology to perform reconciliation tasks, identify discrepancies, and ensure that financial data is accurate and up-to-date, significantly reducing manual effort and errors.

Key Benefits of Automated Account Reconciliation

Increased Efficiency: Manual reconciliation can be time-consuming and labor-intensive, especially for organizations with high transaction volumes. Automated account reconciliation software speeds up the process by handling data matching and reconciliation tasks quickly, freeing up finance teams to focus on more strategic activities.

Enhanced Accuracy: Human errors are a common issue in manual reconciliation, leading to discrepancies and potential financial reporting problems. Automated software uses precise algorithms to match transactions accurately, reducing the risk of errors and ensuring the integrity of financial data.

Real-Time Reconciliation: Automated account reconciliation software often provides real-time reconciliation capabilities, offering immediate visibility into financial status. This real-time access allows organizations to quickly identify and address discrepancies, improving financial oversight and decision-making.

Cost Savings: By automating reconciliation tasks, organizations can reduce the need for manual labor and minimize errors, resulting in significant cost savings. Fewer errors and faster reconciliation processes translate into lower operational costs and less time spent on corrections and audits.

Improved Compliance: Compliance with financial regulations and reporting standards is crucial for avoiding penalties and ensuring accurate reporting. Automated account reconciliation software supports compliance by ensuring all transactions are accurately reconciled and by automating the generation of required reports.

Scalability: As organizations grow, the volume of transactions typically increases, making manual reconciliation increasingly impractical. Automated account reconciliation software scales with business needs, efficiently handling larger transaction volumes and maintaining effective reconciliation processes.

Key Features of Automated Account Reconciliation Software

Automated Matching: The core feature of automated account reconciliation software is its ability to automatically match transactions from internal records with external statements. This functionality reduces manual effort and improves accuracy in identifying and resolving discrepancies.

Exception Handling: The software flags unmatched or unusual transactions, allowing users to investigate and resolve exceptions efficiently. This feature ensures that discrepancies are addressed promptly and accurately.

Integration Capabilities: Automated account reconciliation software often integrates seamlessly with existing financial systems, such as accounting software and ERP platforms, enhancing overall financial management and ensuring data consistency.

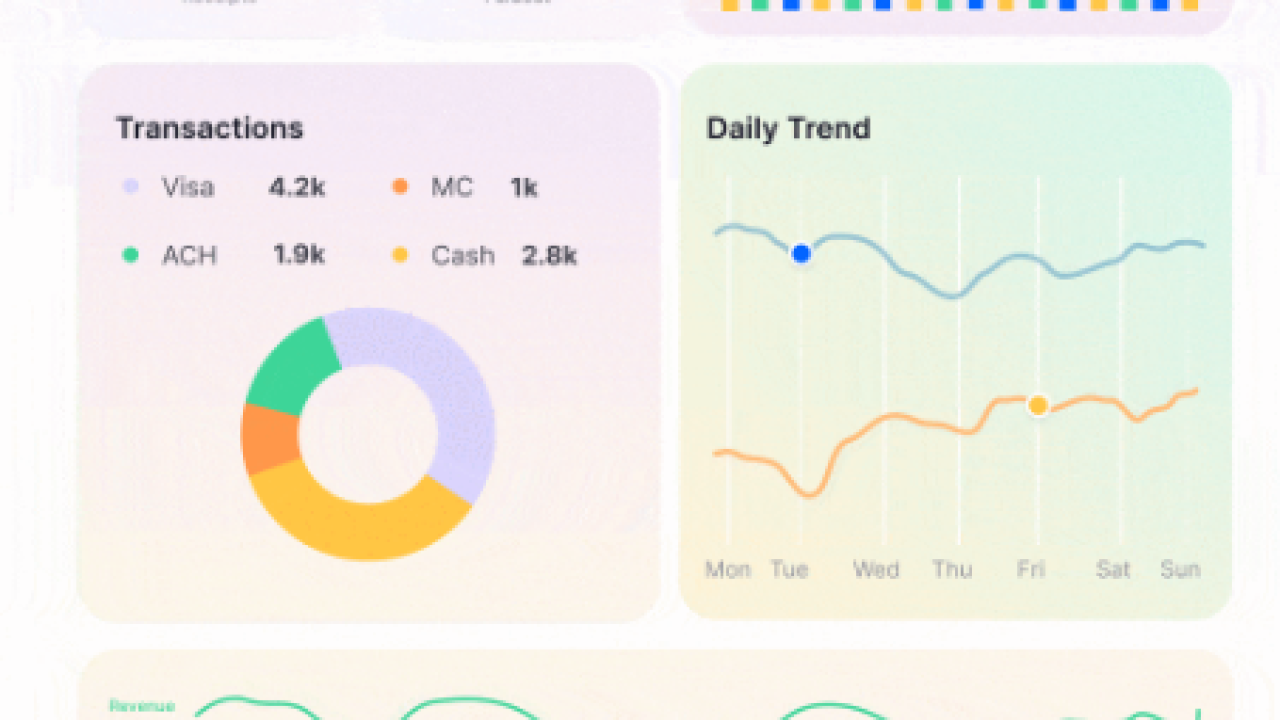

Detailed Reporting and Analytics: The software provides detailed reports and analytics on reconciliation processes, cash positions, and financial performance. Customizable reports support strategic planning and decision-making by offering clear insights into financial data.

Audit Trails: Maintaining an audit trail is crucial for transparency and compliance. Automated account reconciliation software tracks all reconciliation activities, providing a comprehensive record for audits and reviews.

Choosing the Right Automated Account Reconciliation Software

When selecting automated account reconciliation software, consider the following factors:

Functionality: Ensure the software offers the specific features needed for your reconciliation processes, including automated matching, exception handling, and reporting capabilities.

Integration: The software should integrate well with your existing financial systems and banking partners to ensure smooth operations and data consistency.

User Experience: Choose a solution with an intuitive interface that is easy for your finance team to use and navigate.

Scalability: Select software that can scale with your organization’s growth and evolving financial needs.

Support and Training: Look for providers that offer comprehensive support and training resources to help your team effectively implement and use the software.

Conclusion

Automated account reconciliation is transforming financial management by improving efficiency, accuracy, and cost-effectiveness. By automating the reconciliation process, organizations can streamline workflows, reduce manual effort, and gain real-time insights into their financial status. Investing in automated account reconciliation software is a strategic move that enhances operational efficiency and supports better financial decision-making, ultimately contributing to the overall success and stability of the organization.

For more info. visit us:

Balancing Act: Intercompany Reconciliation and Financial Statements Demystified

https://latestsms.in/funny-good-morning-sms.htm

24 July, 2024

https://www.cargoes.com/rostering-system

23 November, 2022

https://www.cargoes.com/rostering-system

92599 Views

http://aptrondelhi.in/

26515 Views

http://www.labelong.com

20 August, 2018