New blog posts

Warum GoodWe in Leipzig die Vorreiterrolle für erneuerbare Energien einnimmt

14 September, 2024 by Evionyx Solar

Die Zukunft der Energiegewinnung ist grün,...

Find Old Tractors at Affordable Rates to Enhance Your Farm’s Productivity

13 September, 2024 by tractor factory

Are you a farmer looking to boost your...

Find Old Tractors at Affordable Rates to Enhance Your Farm’s Productivity

13 September, 2024 by tractor factory

Are you a farmer looking to boost your...

Web Directory

Automated Account Reconciliation: Streamlining Financial Accuracy and Efficiency

Posted on 12 August, 2024 by Kosh.ai

Automated account reconciliation is a transformative technology that simplifies and enhances the process of matching and verifying financial records. By leveraging software to automate these tasks, organizations can achieve greater accuracy, efficiency, and cost savings. Here’s a comprehensive look at automated account reconciliation, its benefits, and key considerations for successful implementation.

1. What is Automated Account Reconciliation?

Automated account reconciliation refers to the use of specialized software to automate the process of comparing and matching financial transactions recorded in internal systems with external documents such as bank statements or invoices. The software utilizes algorithms and predefined rules to streamline the reconciliation process, reducing manual effort and minimizing errors.

2. Key Benefits of Automated Account Reconciliation

Enhanced Efficiency: Automation significantly speeds up the reconciliation process by eliminating manual matching and verification. This increased efficiency allows finance teams to focus on strategic activities rather than routine tasks, improving overall productivity.

Improved Accuracy: Automated reconciliation tools reduce human errors by applying precise algorithms to match transactions. This results in more accurate financial records, fewer discrepancies, and better data integrity.

Cost Savings: By reducing the need for manual intervention, automated reconciliation lowers labor costs associated with traditional reconciliation processes. Additionally, it helps prevent costly errors and potential fraud, leading to further financial savings.

Real-Time Reconciliation: Automation provides real-time visibility into financial data, enabling immediate detection of discrepancies and quicker resolution. This real-time capability supports more informed decision-making and proactive financial management.

Regulatory Compliance: Automated account reconciliation ensures adherence to regulatory requirements by maintaining detailed audit trails and accurate records. This facilitates easier compliance and audit processes, reducing the risk of non-compliance.

3. Key Features of Automated Account Reconciliation Software

Advanced Matching Algorithms: Look for software with sophisticated matching capabilities that can handle various transaction types and data formats. These algorithms should accurately compare and reconcile transactions based on predefined rules.

Exception Management: The software should offer features for managing exceptions and discrepancies, including automated alerts, exception reporting, and workflow tools to efficiently address and resolve issues.

Integration Capabilities: Choose software that integrates seamlessly with existing financial systems, such as accounting software, ERP platforms, and banking interfaces. Effective integration ensures smooth data flow and reduces manual data entry.

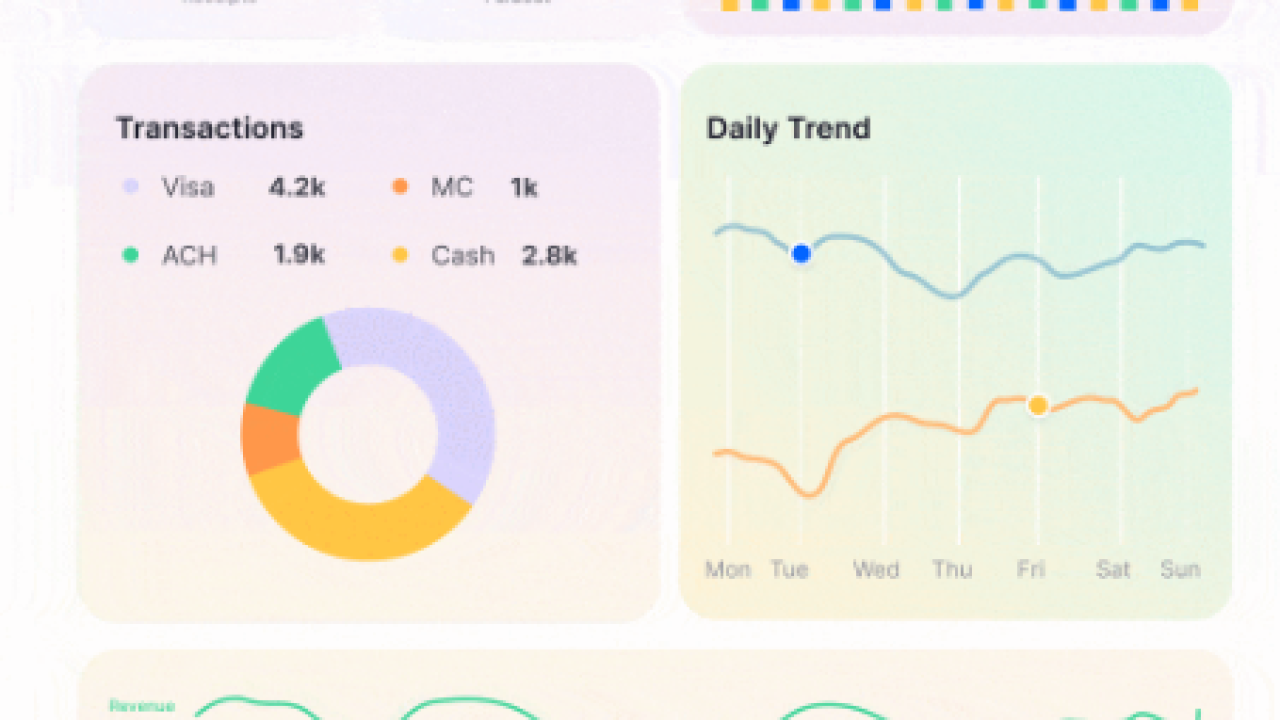

Real-Time Reporting and Dashboards: The tool should provide real-time reporting and customizable dashboards to offer insights into reconciliation status, outstanding discrepancies, and overall financial performance.

User-Friendly Interface: A user-friendly interface is crucial for ease of use. The software should be intuitive, with clear navigation and accessible features to streamline the reconciliation process.

Security and Compliance: Ensure the software adheres to industry standards and regulatory requirements. It should include robust security measures to protect sensitive financial data and support compliance with relevant regulations.

4. Implementing Automated Account Reconciliation

Assess Your Needs: Evaluate your organization’s specific reconciliation needs, such as transaction volume, integration requirements, and reporting preferences. This assessment will help you choose software that aligns with your needs.

Research and Compare: Investigate various automated account reconciliation software options and compare their features, pricing, and user reviews. Consider conducting trials or seeking recommendations to find the best solution for your organization.

Plan for Integration: Ensure that the selected software integrates effectively with your existing financial systems and processes. Proper integration is essential for maximizing the benefits of automation.

Training and Support: Provide comprehensive training for users to ensure they can effectively utilize the software’s features. Additionally, ensure that the vendor offers ongoing support and maintenance to address any issues that may arise.

5. Conclusion

Automated account reconciliation is a powerful tool that enhances financial accuracy and efficiency by automating the reconciliation process. By reducing manual effort, minimizing errors, and providing real-time insights, this software helps organizations streamline their financial operations and achieve greater productivity. When selecting an automated reconciliation solution, consider key features such as advanced matching algorithms, exception management, integration capabilities, and user-friendliness. With the right software, organizations can improve financial accuracy, reduce costs, and ensure regulatory compliance.

For more info. visit us:

AI Wizards in Accounting: How Machine Learning Transforms Finance

https://latestsms.in/funny-good-morning-sms.htm

24 July, 2024

https://www.cargoes.com/rostering-system

23 November, 2022

https://www.cargoes.com/rostering-system

92504 Views

http://aptrondelhi.in/

26513 Views

http://www.calonmarine.com/

15 October, 2018