New blog posts

Warum GoodWe in Leipzig die Vorreiterrolle für erneuerbare Energien einnimmt

14 September, 2024 by Evionyx Solar

Die Zukunft der Energiegewinnung ist grün,...

Find Old Tractors at Affordable Rates to Enhance Your Farm’s Productivity

13 September, 2024 by tractor factory

Are you a farmer looking to boost your...

Find Old Tractors at Affordable Rates to Enhance Your Farm’s Productivity

13 September, 2024 by tractor factory

Are you a farmer looking to boost your...

Web Directory

Maximizing Insurance Customer Retention Through Effective Strategies

Posted on 28 August, 2024 by Mackvain

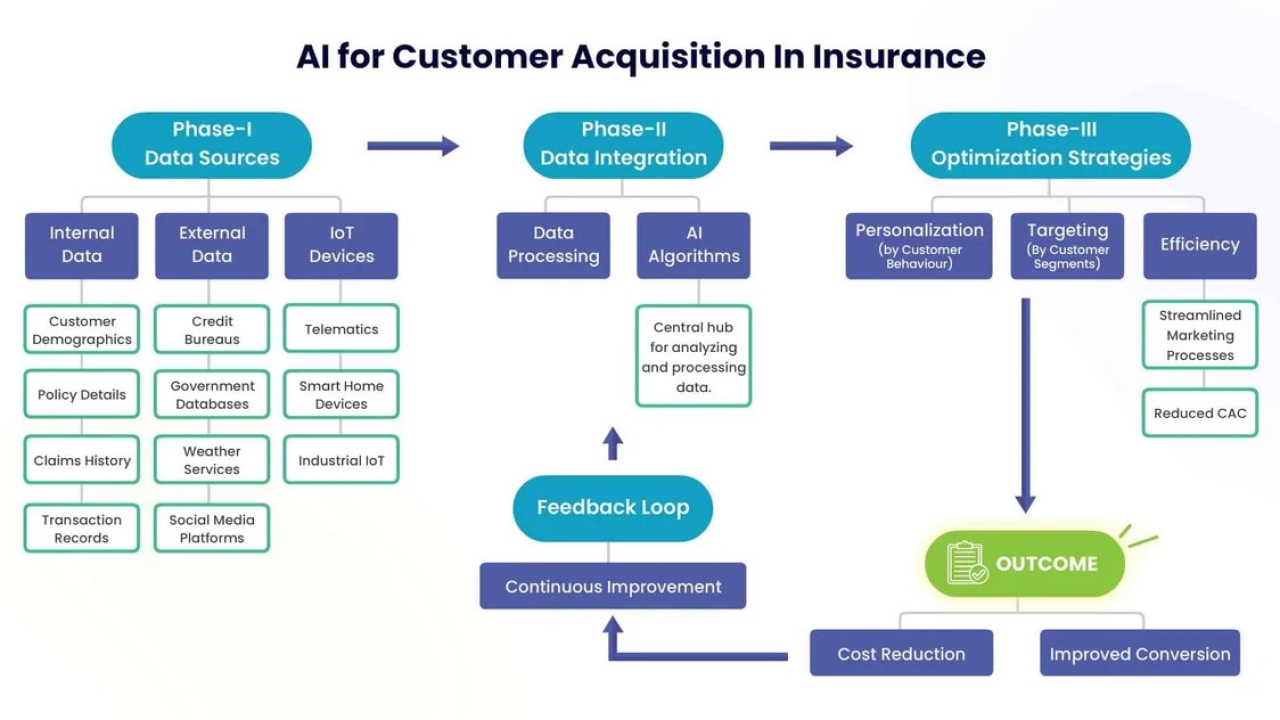

The insurance industry is cut throat as insurance companies are on the lookout for new customers as well as the existing ones. Customer retention is of significance, especially in the context of insurance business due to the fact that it is always cheaper to retain customers than to acquire new ones. It has become increasingly difficult to retain customers and that is why insurers must have proper strategies to use in the market space.

Understanding Insurance Customer Retention

Insurance customer retention can be simply defined as the total capacity of insurance firms to retain their customers. Longer durations present a likelihood of client satisfaction hence making them loyal customers important for the growth of a company’s revenue. Of there factors that determine whether retention strategy works or not, customer service, products offered, prices to be charged, and the ease at which claims can be processed. These are the elements and when one tries to ensure that all of them are in place, and always trying to see that they optimize them, then one sees to it that the customers are retained.

The best strategies to use when aiming at insurance customer retention.

Personalized Customer Experience: Today’s customers are more demanding; they seek solutions that would fit their needs and wants specifically. In the insurance industry, data analytics will enable the insurers to have glimpses into the customers’ tendencies and inclinations. This will enable them to issue site specific policies, communication, and recommendations that fit different clients. It is thus possible to effectively boost customer satisfaction and therefore increase the rate of retention among customers.

Streamlined Claims Process: The claims process is one of the main service delivery processes that impact the customers. The whole process of claiming should be as smooth, efficient and as unambiguous as can be, this always creates an initial good impression in the customer’s mind. Insurers should embrace digital processing and automation of the processes to decrease the time spent and chances of errors while feeding back to the clients in real-time. This is a way to retain customers since offering a claim will come with ease and this will make them confident with the insurer.

Proactive Communication and Engagement: Crosby is quite right to claim that effective and frequent customer communication is the key to positive customer relations. In their case, insurance companies to relay policy updates, reminders and other informative materials using the different touch points including emails, SMS, social media and phone calls. Being in touch and being attentive, insurers can create trust and popularity, thus people would continue to renew their policies.

Loyalty Programs and Rewards: By providing loyalty products incentives the clients would stick with the insurance firm they are currently within. Such offers may range from reduced premiums, cash rebate or additional coverage bonus in case of a long-term customer loyalty.

https://latestsms.in/funny-good-morning-sms.htm

24 July, 2024

https://www.cargoes.com/rostering-system

23 November, 2022

https://www.cargoes.com/rostering-system

92377 Views

http://aptrondelhi.in/

26508 Views

https://www.eliteservices.pk/

12 October, 2019